- Dapatkan link

- X

- Aplikasi Lainnya

The Nebraska state sales and use tax rate is 55 055. Alphabetical by County Nebraska Dept.

Washington Property Tax Calculator Smartasset

For tax rates in other cities see Illinois sales taxes by city and county.

Lincoln ne sales tax rate 2018. Depending on the zipcode the sales tax rate of Lincoln may vary from 55 to 725 Every 2018 Q3 combined rates mentioned above are the results of Nebraska state rate 55 the Lincoln tax rate 0 to 175. There is no applicable special tax. There is no county sale tax for Lincoln.

The Nebraska state sales tax rate is currently. To review the rules in Nebraska visit our state-by-state guide. Certficate of Taxes Levied Report CTL Dec 23 2019.

For tax rates in other. The sales tax jurisdiction name is Lincoln Center which may refer to a local government division. There is no county sale tax for Lincoln.

301 Centennial Mall South. Has impacted many state nexus laws and sales tax collection requirements. Has impacted many state nexus laws and sales tax collection requirements.

Estimated Combined Tax Rate 700 Estimated County Tax Rate 000 Estimated City Tax Rate 150 Estimated Special Tax Rate 000 and Vendor Discount 0025. The Nebraska state sales and use tax rate is 55 055. You can print a 8 sales tax table here.

The Lincoln Nebraska general sales tax rate is 55. Rate variation The 68501s tax rate may change depending of the type of purchase. Of Revenue Property Assessment Division Source.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2021. The Lincoln County sales tax rate is.

County statistics are grouped by county codes. There is no applicable city tax or special tax. You can print a 725 sales tax table here.

The Lincoln sales tax rate is 175. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992020 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. You can print a 875 sales tax table here.

The 2018 United States Supreme Court decision in South Dakota v. The 2018 United States Supreme Court decision in South Dakota v. Crime and Courts Lincoln police channels to be.

There is no applicable special tax. Lincolns voter-approved quarter-cent sales tax being used to build four new fire stations and install a new 911 radio system will end Sept. There is no applicable special tax.

Depending on the zipcode the sales tax rate of Lincoln may vary from 55 to 725 Every 2018 Q1 combined rates mentioned above are the results of Nebraska state rate 55 the Lincoln tax rate 0 to 175. 025 lower than the maximum sales tax in NE. 2019 Change Property Value Taxes Levied.

Sales Tax and Use Tax Rate of Zip Code 69101 is located in North platte City Lincoln County Nebraska State. The 8 sales tax rate in Lincoln consists of 65 Washington state sales tax and 15 Lincoln County sales tax. For tax rates in other cities see Washington sales taxes by city and county.

The 875 sales tax rate in Lincoln consists of 625 Illinois state sales tax 2 Logan County sales tax and 05 Lincoln tax. The combined rate used in this calculator 725 is the result of the Nebraska state rate 55 the Lincoln tax rate 175. 1 State Sales tax is 550.

The Lincoln Nebraska general sales tax rate is 55. There is no applicable county tax or special tax. The 85 sales tax rate in Lincoln consists of 65 Kansas state sales tax 1 Lincoln County sales tax and 1 Lincoln tax.

The 68501 Lincoln Nebraska general sales tax rate is 725.

Gross Receipts Location Code And Tax Rate Map Governments

Nebraska Income Tax Calculator Smartasset

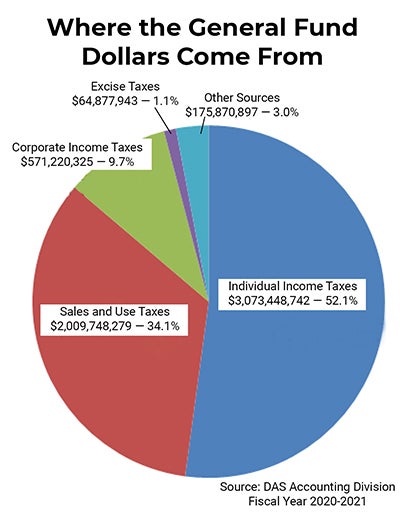

General Fund Receipts Nebraska Department Of Revenue

Sales Tax On Cars And Vehicles In Nebraska

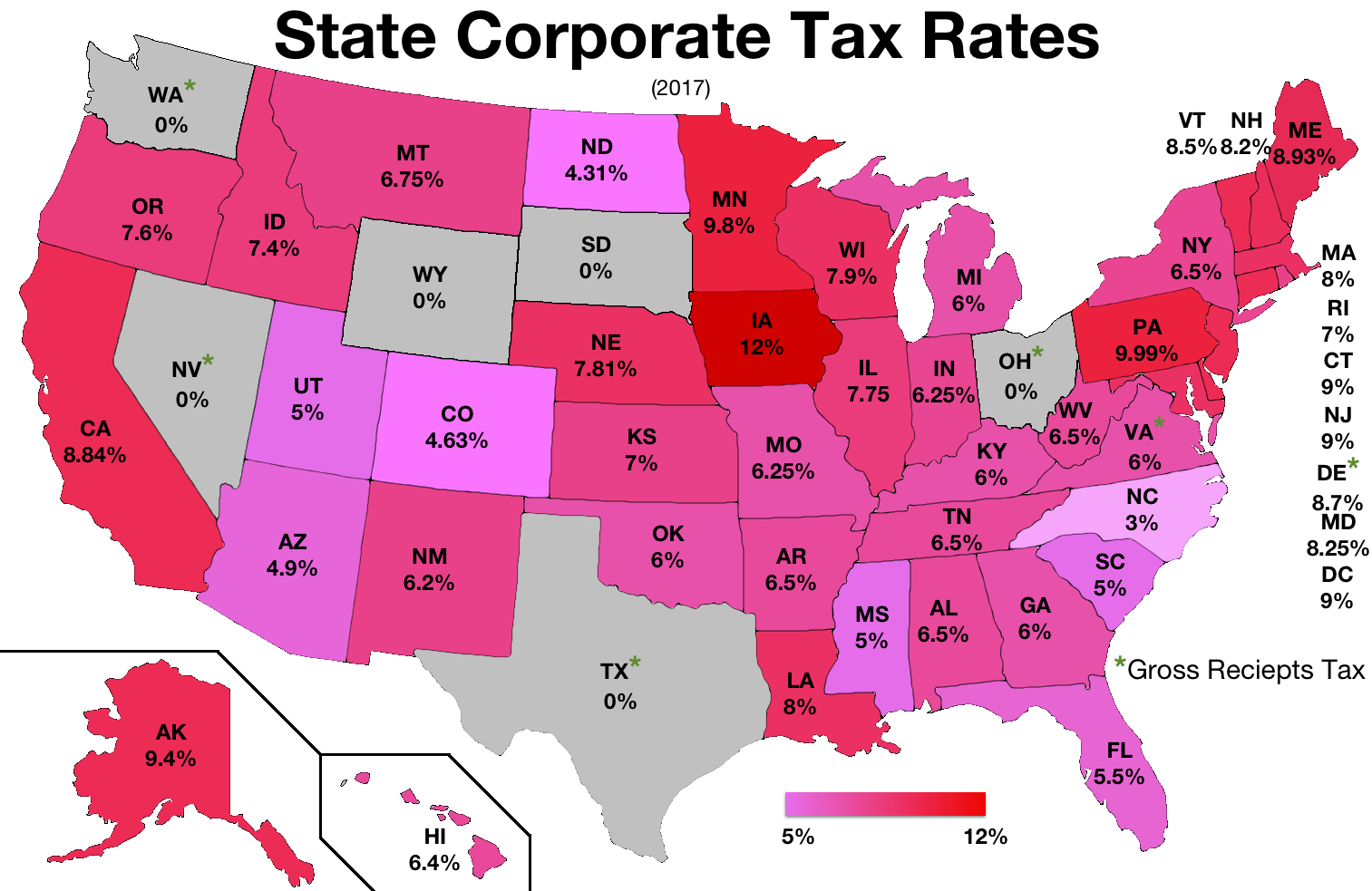

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

7 Ways You Can Earn Tax Free Income The Motley Fool

Https Fortcollinschamber Com Wp Content Uploads 2019 01 Paper From Keep Fort Collins Great Task Force Final1 15 19 Pdf

Oklahoma Property Tax Calculator Smartasset

Louisiana Sales Tax Rates By City County 2021

States With The Highest And Lowest Property Taxes Property Tax States Tax

Corporate Tax In The United States Wikiwand

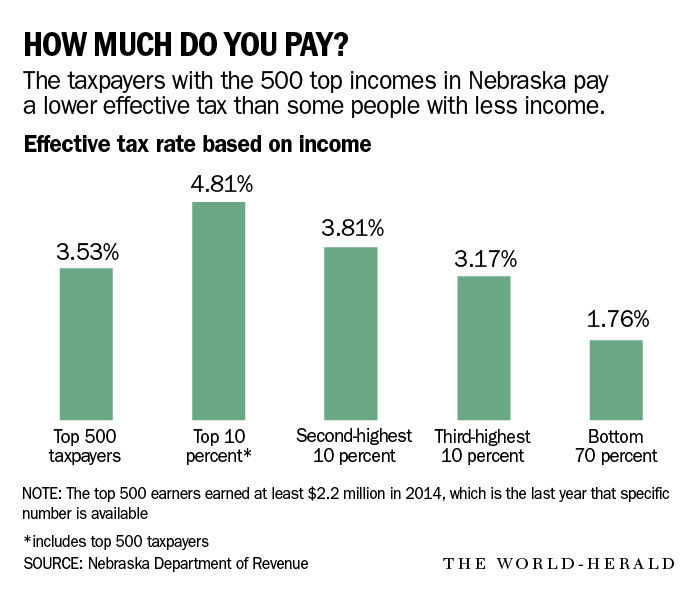

Hansen Want Lower Nebraska Property Taxes We Need To Have A Chat About Income Taxes Archives Omaha Com

Komentar

Posting Komentar